Ways to Start a Career in Accounting and Bookkeeping

The paths to follow in order to have a career in accounting and accounting are as follows;

A University Degree

A common path towards coming an accountant is through getting a university degree. This take about 3 to 4 years of study depending upon which option you choose. The compulsory theoretical training is offered such that the theory, ideas and practice of accounting is laid out for you to understand as you make your way to earning a degree

.

Many people who earn a degree, go on to be a chartered accountant when they complete training and pass the administered exams of regulative bodies in the profession such as the South African Institute of Chartered Accountants. The previously mentioned option is often the choice for those who desire to reach the heights of accounting in their lifetime.

Currently in many countries around the world, the realm of chartered accountancy remains the height of the accounting profession and holders of such titles advance quickly from the boardroom to higher positions in companies.

The Accounting Technician Route

The accounting technician route is open to people who completed their matric and want to have a career in accounting and bookkeeping but without a university degree. This path enables you to complete a series of assessments in order to become a recognized accounting professional with a certificate to boot.

You will also be able to work while you study in any company while being exposed to the practical aspect of accounting.

The number of people who choose to take this route is less than those who go to university to obtain a degree. In any case, it is a great way to head start your career in accounting and bookkeeping.

The Learner Route

Making use of the learner route is another way of getting a foot in the accounting profession. By choosing this route, you could become an accountant in any company or work under the supervision of a skilled accountant who will show you the ropes.

In the learner route, quite a few people end up being knowledgeable bookkeepers without any formal education in the field. What their lack of formal qualifications does not make up for, they cover with their years of experience. Some are able to enter big accounting companies on account of their experience. However it might be incredibly hard for them to reach the very top of big companies or their work environment.

You would be surprised that there are a number of people who have become professional chartered accountants. In spite of starting out on the learner route. Some might choose to go through the accounting service technician route later on in life, pass the examinations and go on to earn a CA classification. Others can return to their studies on a part-time basis, complete a degree as well as the CA requirements as well.

The pathways to a career in bookkeeping or accounting are varied. However if you want to build your career in the profession, hard- work and diligence is needed both in your studies and workplace.

Professions and Benefits in Accounting and Bookkeeping

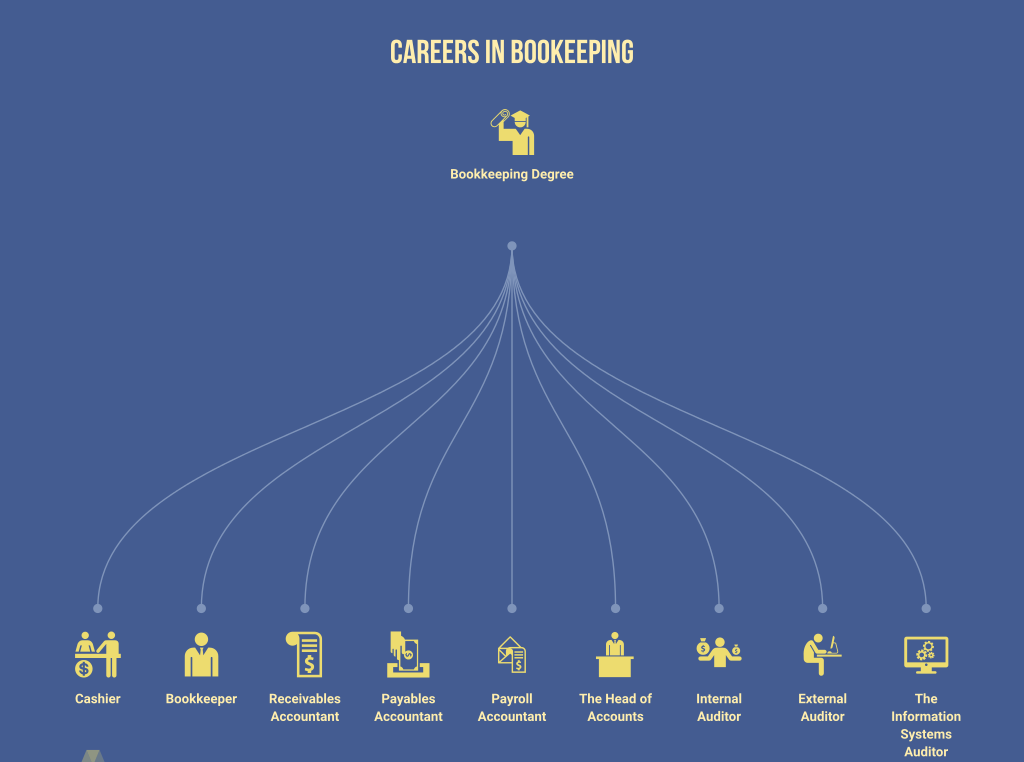

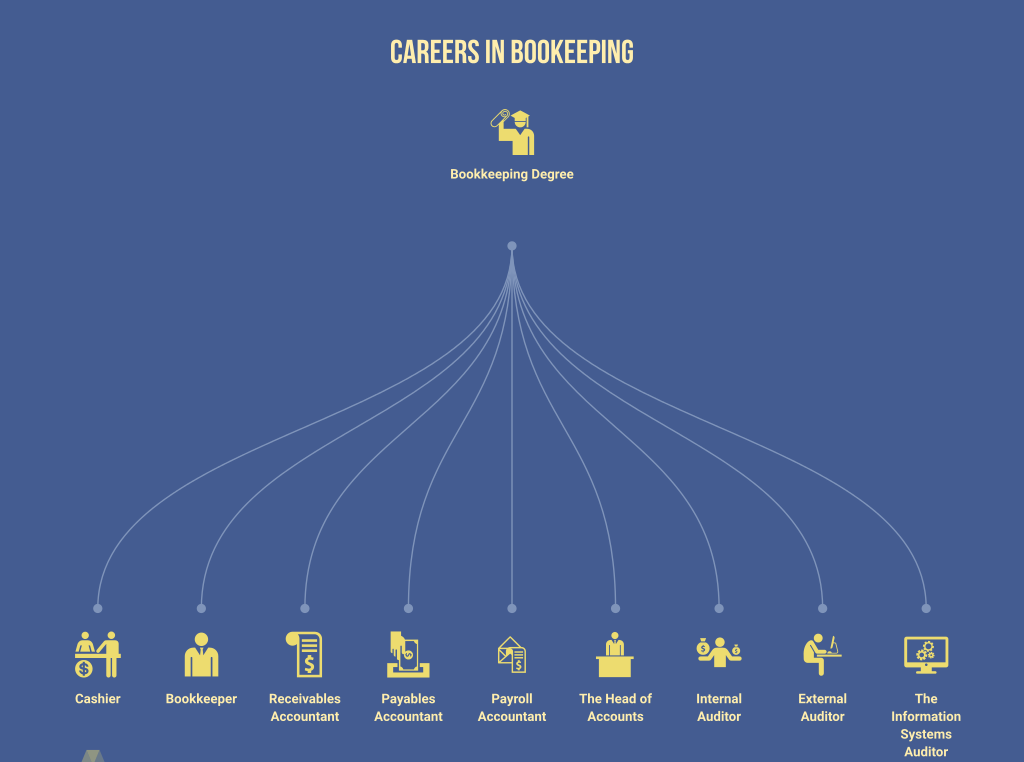

Careers in bookkeeping

Cashier

In small businesses and companies, you will likely find a cashier- a person who receives and deposits money or cheques on a day-to-day basis. In larger organizations, you can have a cashier as well as a cash accountant, depending on the volume or variety of transactions. Different cashiers can be employed in places such as a bank as they require one to address a great deal of people on a day-to-day basis.

There are companies that have continuous customer traffic daily and also require the services of cashiers in order to fulfill their obligations to the public.

In South Africa, a lot of cashiers make approximately R42, 300 yearly although in bigger companies and with greater credentials, you can earn more.

Accountant

A bookkeeper keeps records of day to day transactions and enters them as they are started and/ or completed. These records form the primary core for the monetary statements that will be prepared thereafter by the accountant. In a totally computerized environment, the financial statements will be produced with the aid of software and can be generated on a daily, weekly or month-to-month basis as the case might be.

A junior bookkeeper earns as much as R92, 000 annually while a senior accountant will up to R129, 000 on a yearly basis with the kind of employer and business size playing an essential function.

Receivables Accountant

The receivables accountant handles records of 3rd parties and other interest groups who are expected to pay for items or services that they have enjoyed or taken delivery of, at every point in time. This portfolio is required in huge organizations where you find that the list of parties on the receivables list might extend beyond 100 or more.

The head of receivable accounting area is called a credit controller and commands an income of up to R193, 257 each year. A receivable accountant earns as much as R126, 357 annually and is an excellent paying position throughout the country.

Payables Accountant

The payables accountant will oversee payments to 3rd parties for transactions started by the company. The size of deals handled may demand for such a portfolio and the larger the number of people, the more necessary it becomes.

A payables accounting professional earns approximately R193, 357 annually and is a good paying position throughout the country. Junior staff members on this task earn above R125, 000 every year.

Payroll Accountant

In small and sometimes, medium scale organizations; there may not be a requirement for a payroll accountant a result of the few staff members. However, with larger size comes a need for this portfolio in order to maintain integrity, proper control and accuracy.

A payroll accounting professional makes as much as R160, 082 yearly and is a position frequently in demand.

The Head of Accounts

In order understand function of this position, it is very important to acknowledge that somebody has to take responsibility for the monetary statements of a company.

In preparing, reviewing and licensing financial statements for utility management, Board or the total authority, a head of accounts area requires to be organized and active. The position requires a level of ability and competence such as that of an accounting designation like a Chartered Accountant.

Considering that this role is often occupied by CA’s and skilled accountants, it comes highly prized with compensation of as much as R439, 064 or more on a yearly basis.

Internal Auditor

The internal auditor is an essential part of medium and big organizations as the requirement to check, manage and authorize transactions ends up being paramount with the increasing scale of resources

.

In some companies, the variety of portfolios in the audit department can be as diverse as possible depending on the intricacy of deals.

Those in entry level positions can earn up to R200,656 while those more experienced earn up to R300,000 on an annual basis.

External Auditor

The external audit roles are performed by professional accountancy firms and they hire a variety of personnel to fill up their company. While a Chartered Accountant with specified levels of working experience is constantly required to head such firms, other low and middle level positions within the company can be filled by learners, degree holders and other newly qualified chartered accountants and skilled personnel with varying levels of experience.

For a position such as that of an External Auditor, one can earn between R400,000 to R600,000 or more depending on area, experience and other elements such as the structure of company.

The Information Systems Auditor

The increasing wave of computerization and digital advancements around the world has caused a new branch in accounting to emerge in the last three decades. The information systems auditor is typically an accounting expert although people with experience in financial and computer-based education may also qualify for this position.

The role demands that the person is constantly on the watch to approve and ensure the integrity of the innovation end that caters for the financial deals of the company. Areas like these are continually developing as the digital boundaries expand and accounting and bookkeeping specialists discover new ways in which to occupy with their specialty.

An accredited info systems auditor makes more or less R450,000 every year and is a scarce skill in South Africa.

Conclusion

Specialists in the field of accounting and bookkeeping find relevance in many facets of life and human activity on a daily basis. Their task is to keep businesses afloat, keep homes together and fortunes of lots of families depend on their competence.

Government works on the vital contributions made by them in tax collection and accounting throughout the provinces. Profits collections by federal government departments are anchored on the core abilities provided by these economists much like business and other companies across the nation do. Daily, records are kept of loans received, payments made, products, sales and products gotten on credit for referral along with control functions.

The different activities carried out in accounting and bookkeeping provide a needed safeguard for federal government decisions, organizational expansion, recruitment of talents along with further growth or downsizing.

There is no doubt that a profession in accounting and bookkeeping is a mouth-watering one with numerous alternatives for study and practice.

People have the choice of selecting from a mix of university-driven education, accounting technician programs or the learner route as they consider their future profession. By performing their roles in the companies they are positioned, monetary records are created, reviewed and licensed for use by different stakeholders across the government and economic sector divides. They keep organisations interfaced with monetary providers, lending institutions and regulatory authorities with crucial documentations, reports and activities.

Knowing that monetary integrity can not be secured without this class of individuals, society places importance on the services provided and this shows in the above par compensation enjoyed by individuals who work in this occupation.

The least paid class of workers in this field receive approximately R42,000 every year while the most highly paid get reimbursements in excess of R1million as experienced Chartered Accountants.

Course Information

A course in accounting and bookkeeping can be done through several institutions which offer various routes to a satisfying career.

You can reach this college on the best ways to attain your imagine a viable education through these paths:

Association of Accounting Technicians of South Africa

Classes that prepare you for evaluations by the Association of Accounting Technicians of South Africa can be accessed to give you the right theoretical background for an accounting or bookkeeping career. Enroll for these classes to gain a good grasp of what is needed for evaluations.

South Africa Institute of Chartered Accountants

The South African Institute of Chartered Accountants has various levels of assessments and you can gain a good level of understanding of the evaluation syllabus with preparatory classes tailored to give you a successful result.

Institute of Certified Bookkeepers, South Africa

The

Institute of Certified Bookkeepers, South Africa accredits your credentials and you can become a member having finished a recognized core curriculum. Well informed classes that conform to the expectations of the

ICB will lead you to an excellent start as you complete your accounting education and pass the anticipated assessments in flying colors.

ICB Bookkeeping Courses

bookkeeping courses south africa |

Last updated : May 3, 2017

In the learner route, quite a few people end up being knowledgeable bookkeepers without any formal education in the field. What their lack of formal qualifications does not make up for, they cover with their years of experience. Some are able to enter big accounting companies on account of their experience. However it might be incredibly hard for them to reach the very top of big companies or their work environment.

You would be surprised that there are a number of people who have become professional chartered accountants. In spite of starting out on the learner route. Some might choose to go through the accounting service technician route later on in life, pass the examinations and go on to earn a CA classification. Others can return to their studies on a part-time basis, complete a degree as well as the CA requirements as well.

The pathways to a career in bookkeeping or accounting are varied. However if you want to build your career in the profession, hard- work and diligence is needed both in your studies and workplace.

In the learner route, quite a few people end up being knowledgeable bookkeepers without any formal education in the field. What their lack of formal qualifications does not make up for, they cover with their years of experience. Some are able to enter big accounting companies on account of their experience. However it might be incredibly hard for them to reach the very top of big companies or their work environment.

You would be surprised that there are a number of people who have become professional chartered accountants. In spite of starting out on the learner route. Some might choose to go through the accounting service technician route later on in life, pass the examinations and go on to earn a CA classification. Others can return to their studies on a part-time basis, complete a degree as well as the CA requirements as well.

The pathways to a career in bookkeeping or accounting are varied. However if you want to build your career in the profession, hard- work and diligence is needed both in your studies and workplace.

In preparing, reviewing and licensing financial statements for utility management, Board or the total authority, a head of accounts area requires to be organized and active. The position requires a level of ability and competence such as that of an accounting designation like a Chartered Accountant.

Considering that this role is often occupied by CA’s and skilled accountants, it comes highly prized with compensation of as much as R439, 064 or more on a yearly basis.

In preparing, reviewing and licensing financial statements for utility management, Board or the total authority, a head of accounts area requires to be organized and active. The position requires a level of ability and competence such as that of an accounting designation like a Chartered Accountant.

Considering that this role is often occupied by CA’s and skilled accountants, it comes highly prized with compensation of as much as R439, 064 or more on a yearly basis.

The different activities carried out in accounting and bookkeeping provide a needed safeguard for federal government decisions, organizational expansion, recruitment of talents along with further growth or downsizing.

There is no doubt that a profession in accounting and bookkeeping is a mouth-watering one with numerous alternatives for study and practice.

People have the choice of selecting from a mix of university-driven education, accounting technician programs or the learner route as they consider their future profession. By performing their roles in the companies they are positioned, monetary records are created, reviewed and licensed for use by different stakeholders across the government and economic sector divides. They keep organisations interfaced with monetary providers, lending institutions and regulatory authorities with crucial documentations, reports and activities.

Knowing that monetary integrity can not be secured without this class of individuals, society places importance on the services provided and this shows in the above par compensation enjoyed by individuals who work in this occupation.

The least paid class of workers in this field receive approximately R42,000 every year while the most highly paid get reimbursements in excess of R1million as experienced Chartered Accountants.

The different activities carried out in accounting and bookkeeping provide a needed safeguard for federal government decisions, organizational expansion, recruitment of talents along with further growth or downsizing.

There is no doubt that a profession in accounting and bookkeeping is a mouth-watering one with numerous alternatives for study and practice.

People have the choice of selecting from a mix of university-driven education, accounting technician programs or the learner route as they consider their future profession. By performing their roles in the companies they are positioned, monetary records are created, reviewed and licensed for use by different stakeholders across the government and economic sector divides. They keep organisations interfaced with monetary providers, lending institutions and regulatory authorities with crucial documentations, reports and activities.

Knowing that monetary integrity can not be secured without this class of individuals, society places importance on the services provided and this shows in the above par compensation enjoyed by individuals who work in this occupation.

The least paid class of workers in this field receive approximately R42,000 every year while the most highly paid get reimbursements in excess of R1million as experienced Chartered Accountants.

The Institute of Certified Bookkeepers, South Africa accredits your credentials and you can become a member having finished a recognized core curriculum. Well informed classes that conform to the expectations of the ICB will lead you to an excellent start as you complete your accounting education and pass the anticipated assessments in flying colors.

ICB Bookkeeping Courses

bookkeeping courses south africa |

Last updated : May 3, 2017

The Institute of Certified Bookkeepers, South Africa accredits your credentials and you can become a member having finished a recognized core curriculum. Well informed classes that conform to the expectations of the ICB will lead you to an excellent start as you complete your accounting education and pass the anticipated assessments in flying colors.

ICB Bookkeeping Courses

bookkeeping courses south africa |

Last updated : May 3, 2017